YEAR-END TIDBITS

Q: You’ve been preparing taxes for 98,172 years. What kind of mistakes do you see year after year?

– Mel Brookstein, the 1000 year old man

A: Here’s one! Self-employed or taxpayers with substantial investments often do not keep accurate track of their estimated tax payments. The IRS and States do keep track, so you may end up with a hefty bill should you report more payments than you actually made. And you were not planning on that bill, which will include interest and penalties.

The super-simple method to keep track is to pay the IRS on-line through EFTPS, a free government site. Some states like Massachusetts are also set up for on-line payments.

Q: For 2017, my resolution is to help disadvantaged groups, like ex-felons, obtain employment. As a business owner I absorb some risk. Are there any tax incentives?

– Robert “Birdman of Alcatraz” Stroud

A: Actually, yes. As an incentive to hire ex-felons, welfare recipients, veterans, disadvantaged teens or other groups with barriers to employment, the Work Opportunity Tax Credit offers credits to businesses. The credits are per employee, and vary based on the “targeted group” the employee is part of. The maximum credit can be low — the range is $1,200 to $9,600 per employee — but for a small employer wanting to make a difference it does provide some remuneration. Potential employees must be screened by a local workforce agency. Full details here

For non-profits, the credit is only applicable for hiring veterans.

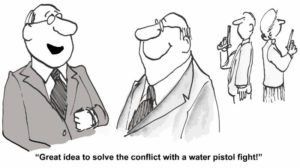

ALSD is now partnering with Dispute Resolution LLC, to provide mediation services. Specifically, I will be a financial adviser helping clients during the mediation process. Owner Jay Candon is an experienced mediator in business, personal and landlord-tenant disputes. I have always been a fan of mediation — I used it successfully in my divorce, and have seen its effectiveness is resolving business issues.